In today’s fast-paced digital world, streamlining how you collect payments is crucial for any business, whether you’re a freelancer, small business owner, or large enterprise. Buzz Business Cloud’s Payment Links offer a powerful and versatile solution to simplify your payment collection and enhance your business operations. Originally launched in 2019 as a simple payment collection tool, we have evolved into a dynamic solution designed to meet the diverse needs of modern businesses.

It’s the perfect solution for entrepreneurs, freelancers, and businesses with a limited service offering or a few products for sale. They allow you to create unique, digital payment collection pages that can be shared with anyone to collect funds quickly. You don’t even need a full e-commerce website to use them! It’s the perfect way to collect one-off fees or manage your fixed service payments. Let’s briefly explain how you can adjust Payment Links to suit your business needs.

How Buzz Payment Links Work:

- Create Custom Payment Links: Generate a unique link for each service or product you offer.

- Customise Your Links:

- Add Product Information: Clearly define what your client is paying for.

- Collect Client Information: Use custom fields to gather essential details like names, contact information, and service preferences.

- Set Pricing: Choose between fixed fees, minimum payment requirements, or allow customers to enter their own amount. For larger purchases, you can even enable payment plans.

- Buyer Incurs Fees Capability: You have the option to pass transactional platform fees onto your buyers.

- Add a Visual Touch: Enhance your payment link’s appearance with an image or logo for brand recognition.

- Shareable Payment Pages: Once created, you can share your Payment Link via QR Code, social media platforms, email, or WhatsApp, reaching your customers wherever they are.

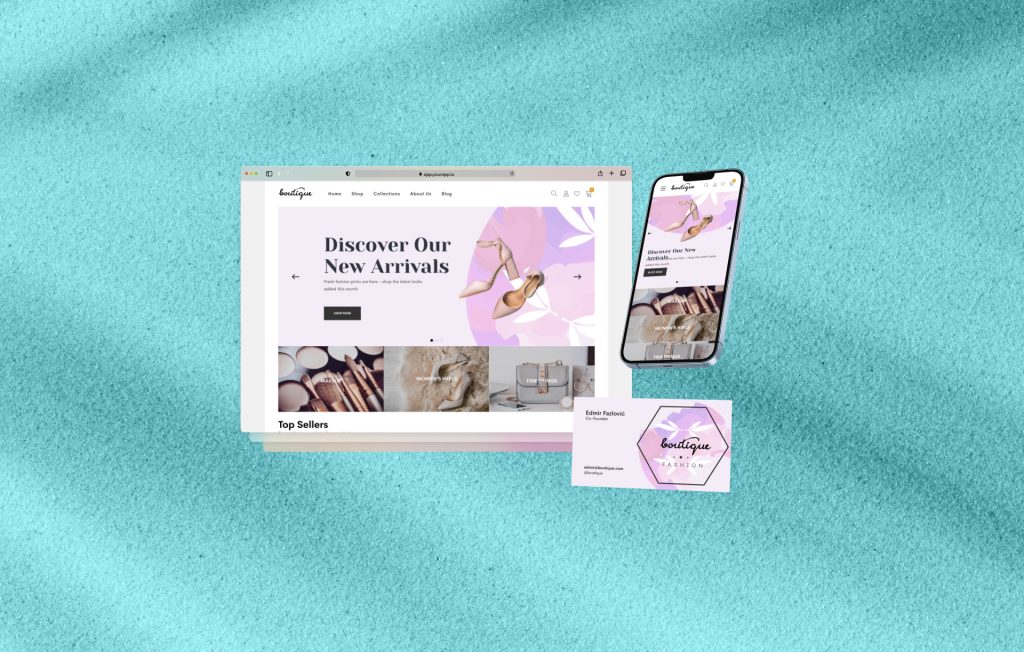

- Seamless Integration with Your Website (Optional but Powerful!): While not required, you can easily embed Payment Links directly into your existing website using customisable button code snippets. This button will guide users to our secure payment page when clicked, and after a successful transaction, a redirect link can bring them back to your website, creating a seamless customer purchasing journey.

- Distribute Digital Purchases: When creating Payment Links, you can attach digital download files such as images, e-books, music files and more. Automatically provide digital downloads to customers immediately after their purchase.

- Secure and Reliable: All payments are processed securely through our trusted payment gateway, Buzz Payments, which powers all of our Buzz Cloud e-commerce platforms. Visa and Mastercard credit and debit cards are accepted.

*Disclaimer: Payment Links feature availability varies depending on your chosen plan. Visit our Buzz Business Cloud Pricing Page to see all features & compare plans.

Payment Links For Business Fee Collection

The core idea is to simplify fee collection for various services, allowing customers to easily pay for one-time services, project milestones, or recurring retainers. This is beneficial for a wide range of professionals in various industries, including education, law, art & design, beauty and more, as it enables customers to prepay or settle additional charges with ease. Here’s a breakdown of how different types of payment links can be utilised:

Fixed-Fee Payment Links:

- Purpose: These links are designed for services or products with a predetermined, set price.

- How it works: The service provider creates a link with a specific amount attached. When the customer clicks the link, they are prompted to pay that exact amount. This is ideal for services where the price is non-negotiable and clearly defined.

- Examples:

- Barbers/Hair Stylists: A standard link for a “Standard Haircut” at $300, or a “Wash and Blowout” at $500, can be sent to clients to collect fees when booking their appointment.

- Consultants (One-Time): A link for a “30-Minute Initial Consultation” at $600.

- Digital Content Creators: A link for a digital download product can be attached to your website or social media, where customers can purchase and instantly download the digital file. An “E-book: Mastering Digital Marketing” at $200 can be sold by a marketing firm via their website. A “Premium Icon Pack” at $150 can be sent by a designer to an interested lead by email or WhatsApp. A Photographer can sell a digital download of a “Poui In Bloom” for $300 via a link on their Instagram.

- Tutors: A link for “Online Tutoring Session (1 hour)” at $250 can be sent to parents or students for advanced collection.

- Fitness Instructors: A link for a “Virtual Group Fitness Class” at $150 can be sent to potential class attendees.

Open-Ended Payment Links (for “additional charges” or variable services):

- Purpose: These links are for situations where the final amount isn’t known upfront, or where customers need to pay for a variable amount (e.g., based on time, materials, or unforeseen issues). They are particularly useful for settling “additional charges” that may arise during the course of service fulfilment.

- How it works: The service provider creates a link without a preset amount or a minimum fee amount that covers the base figure for their services. When the customer clicks the link, they are prompted to enter the amount they wish to pay, based on pre-arranged discussions. This gives flexibility for payments that are negotiated, variable, or cover unforeseen expenses.

- Examples:

- Lawyers: After an initial retainer, a lawyer might send an open-ended link for a client to pay for additional hours billed, court filing fees, or specific research costs. The client can then enter the exact amount requested by the lawyer.

- Mechanics: If a mechanic discovers additional necessary repairs beyond the initial quote (e.g., a “Diagnostic Fee” of $50, or “Unexpected Part Replacement” for a specific cost), they can send an open-ended link and instruct the customer to input the agreed-upon additional charge.

- Seamstresses: For custom projects where the material cost or complexity varies, a seamstress might send an open-ended link for a “Final Payment” after the garment is completed, allowing the customer to enter the remaining balance.

- Consultants (Project Milestones/Retainers): For project-based work, a consultant could send an open-ended link for a “Project Milestone Payment” where the client inputs the agreed-upon instalment amount. For recurring retainers, the client could use an open-ended link to pay the monthly retainer amount.

- Digital Service Providers (Custom Work): For custom digital design projects or personalised software development, an open-ended link allows clients to pay for agreed-upon variable project costs.

Examples of Using Buzz Payment Links for Your Business

By offering both types of payment links, service providers can streamline their billing process, provide convenience to their customers, and ensure timely payment for a wide range of services and scenarios. Let’s look at some examples of how Buzz Payment Links can be used by entrepreneurs, freelancers, consultants, and even large businesses to improve their fee collection processes.

- Educators: Collect course registration fees, workshop fees, and membership dues for your educational programs. You can create individual fixed-fee payment links for each course, making it easy for students to pay directly and securely.

- Artisans and Crafters: The open-ended Payment Link is perfect for collecting varying fees for bespoke services or custom orders. This allows you to easily collect different amounts for custom orders or unique services, as the link allows customers to enter the specific agreed-upon price themselves.

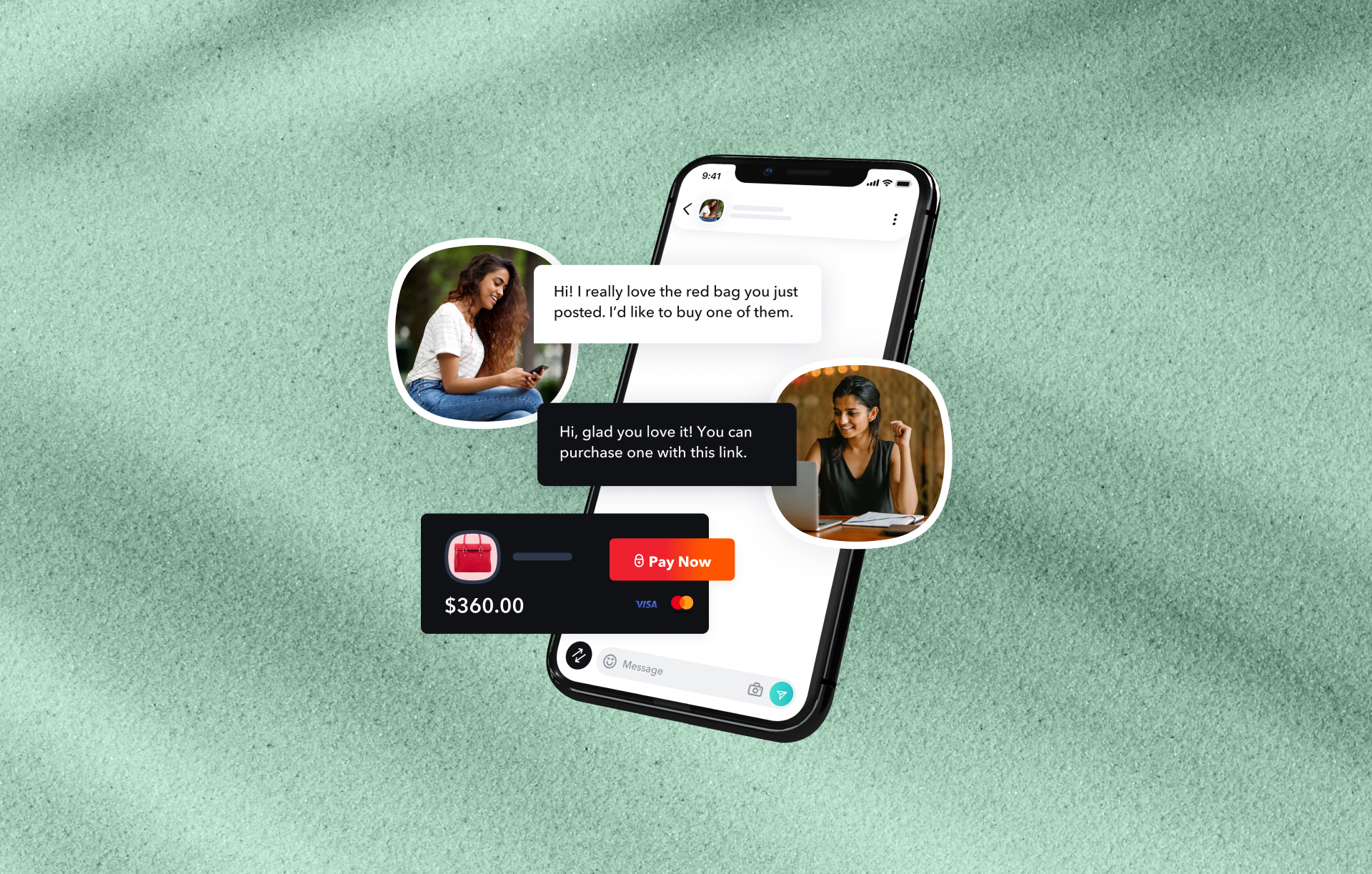

- Social Media Sellers: If you sell services or products through social media platforms and marketplaces, Payment Links provide a safe and secure way to get paid. The open-ended Payment Link is particularly beneficial as it allows you to collect varying fees for bespoke services or custom orders, making it ideal for unique transactions often found on social media.

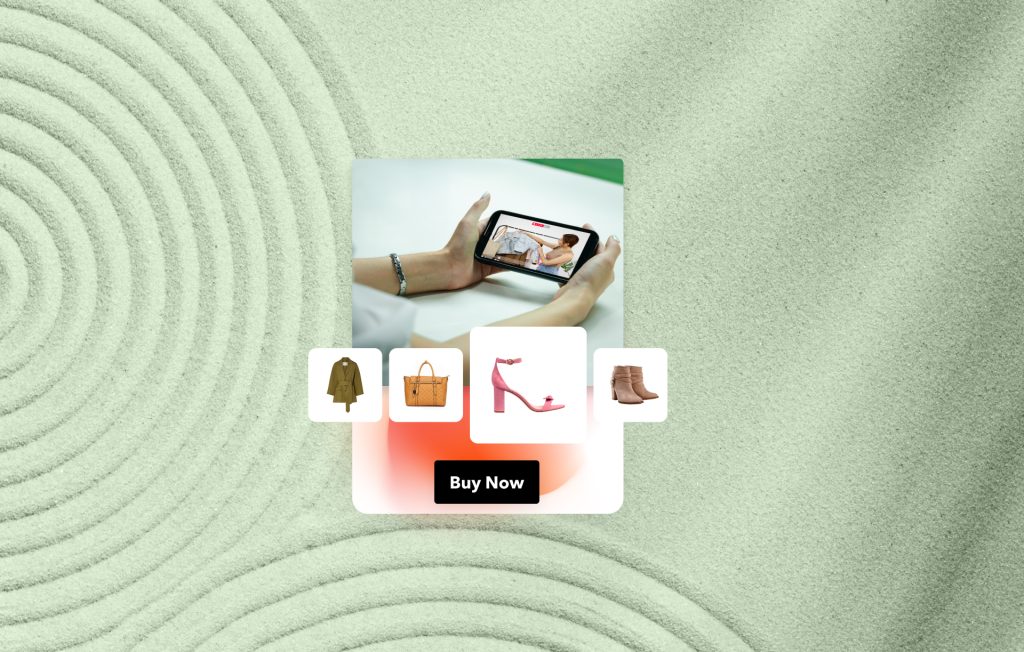

- Digital Content Creators/Sellers: For businesses offering digital downloads (e-books, templates, software, music, stock photos, online courses), fixed-fee payment links are ideal for direct sales. For custom digital products or licensing agreements, open-ended links can be used to collect varying fees.

- Software and SaaS Companies: Use fixed-fee links for one-time software purchases. Open-ended links can be utilised for custom enterprise solutions, consulting services, or additional feature upgrades.

- Consulting Firms: Fixed-fee links can be used for standard package deals or initial consultation fees. Open-ended links are perfect for collecting varying fees based on project scope, hourly rates, or retainer agreements.

- Real Estate Agencies: While large transactions typically involve bank transfers, payment links can be useful for collecting application fees, reservation deposits, or even smaller administrative fees for property management. Fixed-fee links can be used for standardised fees, while open-ended links could be used for varying inspection or appraisal fees.

- Logistics and Shipping Companies: For smaller, less frequent, or ad-hoc services, fixed-fee links could be used for standard delivery charges. Open-ended links could be beneficial for collecting varying charges for customs duties, specialised handling, or unexpected surcharges.

Ready to Streamline Your Payments?

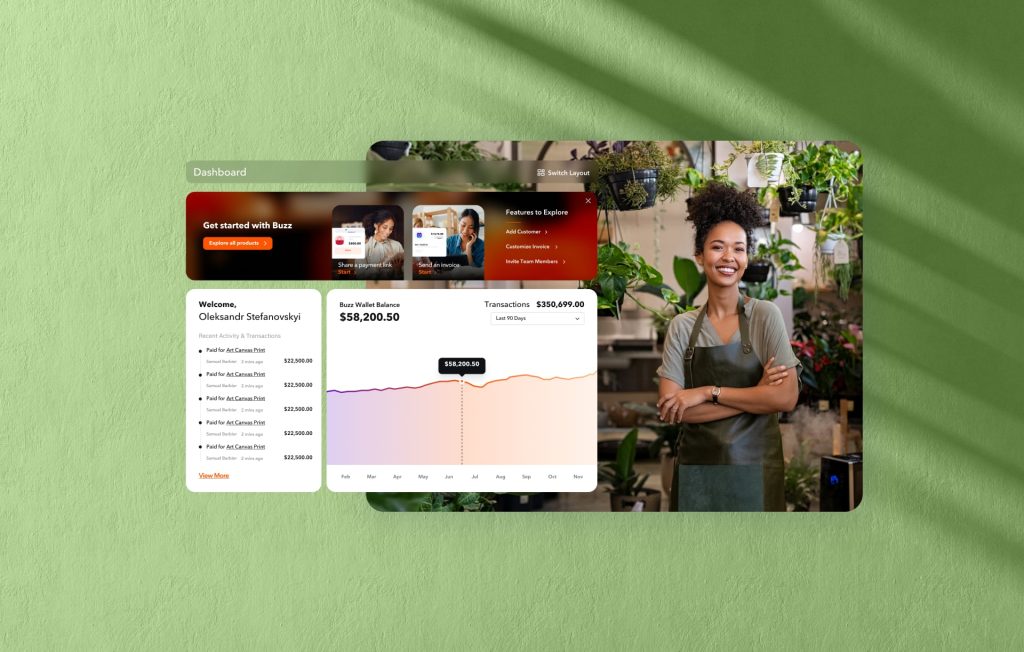

Buzz Business Cloud empowers you to take control of your online payments. By leveraging Payment Links, you can enhance customer satisfaction, increase conversions, and streamline your operations. Make it easy for clients to pay you as soon as possible!

Sign up for a Buzz Business Cloud account today and start accepting online payments with ease! You’ll also discover the rest of our array of payment solutions, including Invoices, Subscriptions, Appointments, and Donations for NGOs.