In the dynamic world of business, efficient billing and payment collection are paramount. For entrepreneurs, freelancers, and businesses of all sizes, managing invoices can often be a time-consuming task. Traditional invoicing and estimate systems are a time-consuming nightmare, involving endless manual tasks like printing, stuffing, and mailing. Generating estimates requires painstaking precision to avoid errors. Tracking payment collections becomes a dramatic and labyrinthine exercise of cross-referencing, typically leading to misplacement or oversight. Reconciling accounts is a dreaded, labour-intensive audit, as you hunt for discrepancies amongst piles of paperwork. Each step, from creation to collection, is a drain on valuable time and resources, diverting focus from core business activities.

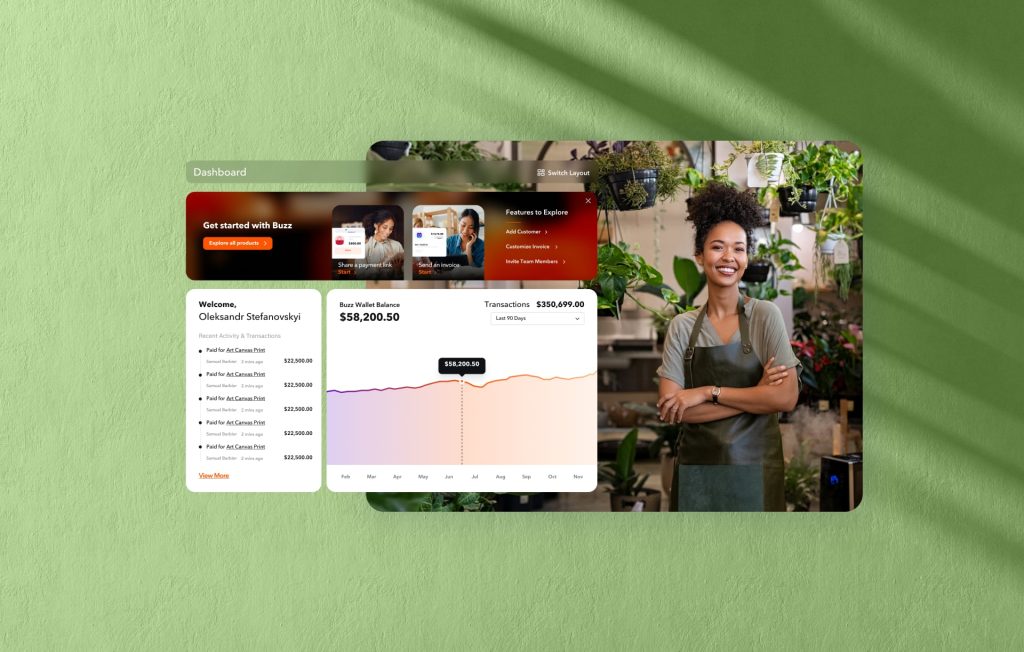

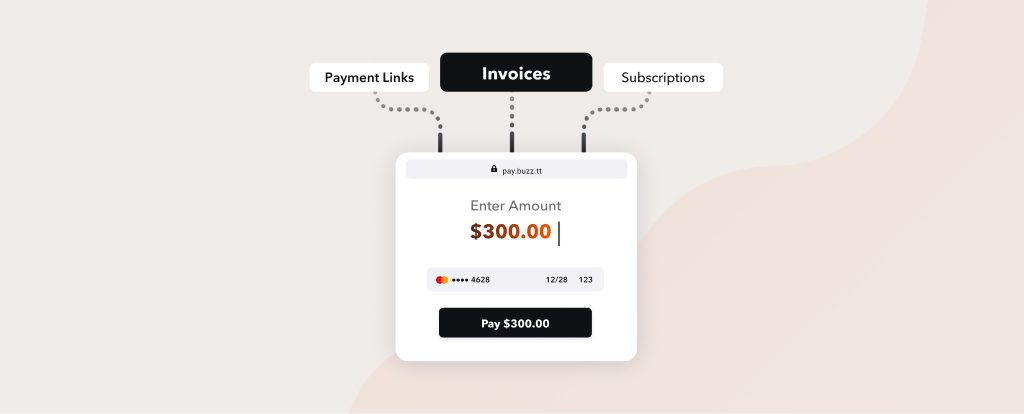

Buzz Business Cloud offers a powerful and intuitive solution: Buzz Invoices. This tool is designed to simplify your billing process, enhance payment collection, and provide superior tracking compared to traditional paper-based methods. It is a simple yet robust digital solution for creating, sending, and tracking estimates and invoices. You don’t need a complex e-commerce website to use them; they are ideal for businesses with dedicated service offerings that require an easily trackable system for online payment collection. Whether you’re collecting one-off fees or managing recurring payments, Buzz Invoices makes the process quick and easy.

How Buzz Invoices Work:

Creating and managing invoices and estimates with the Buzz Business Cloud is straightforward and feature-rich:

- Create Custom Invoices: Generate detailed invoices with line items for each service or product you offer. You can even save popular line items for quicker creation in the future.

- Submit Convertible Estimates: Need to provide a quote first? Create and send online estimates. Once your client approves, you can easily convert the estimate into a formal invoice and send it digitally.

- Customise Your Invoices:

- Add Invoice & Reference #s: Use your existing numbering system, or let the system auto-generate numbers for you.

- Digitise Due Dates: Set clear payment deadlines. Our system not only displays these on your invoice but also automates the tracking of overdue invoices, helping you stay on top of your receivables.

- Add a Visual Touch: Choose from various templates and incorporate your logo and brand colours to ensure your invoices reflect your brand’s professionalism.

- Set Flexible Pricing: Apply discounts, shipping charges, and taxes as needed. For larger transactions, you can enable payment plans, and we’ll handle the collection process.

- Recurring Invoices: While Buzz Subscriptions handle recurring payments, Invoices are perfect for one-off charges like setup fees, custom upgrades, or additional services not covered by the standard subscription.

- Send Invoice Pages: Share your created invoice with clients via a direct URL, email, or WhatsApp, making it convenient for them to access and pay.

- Secure and Reliable Payments: All payments are processed securely through Buzz Payments, our trusted payment gateway that powers all Buzz Cloud e-commerce platforms. We accept Visa and Mastercard credit and debit cards.

Invoice Monitoring & Management:

Buzz Invoices aren’t just about sending bills; they provide comprehensive tools for managing your accounts receivable:

- Payment Status At A Glance: Our automated status tags immediately show you which invoices are current, overdue, or paid, eliminating the need for manual tracking.

- Automated Revenue Tracking: Gain insights into your payment progress over time, including the number of transactions, total revenue generated, and outstanding fees.

- Cancel Created Invoices: Easily cancel previously created invoices with immediate changes.

- Digital Download: Download invoices to your desktop for printing or accounting purposes.

*Disclaimer: Invoice feature availability varies depending on your chosen plan. Visit our Buzz Business Cloud Pricing Page to see all features & compare plans.

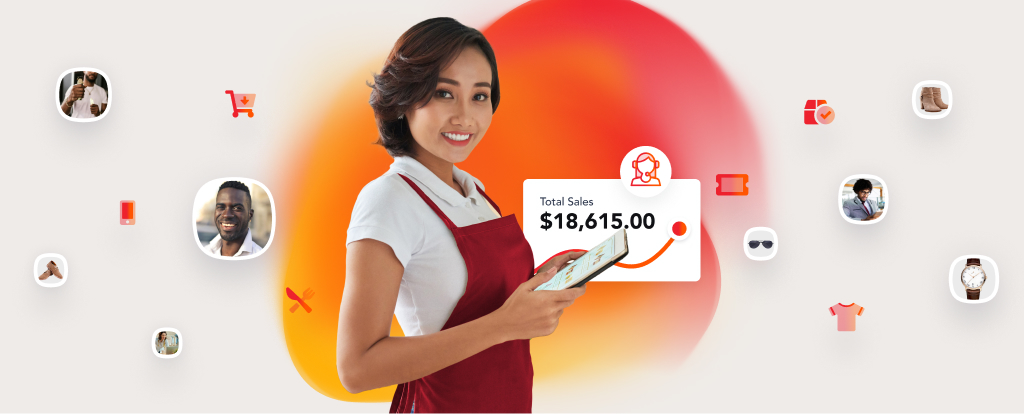

Examples of Using Buzz Invoices for Your Business:

Buzz Invoices offer immense versatility for various business types:

- Service Providers (Consultants, Agencies, Repair Services): Easily bill clients for projects, hourly work, or specific services. For instance, a marketing consultant can send an invoice for a completed campaign, or a repair shop can bill for parts and labour.

- Professionals (Lawyers, Accountants): Generate detailed invoices for legal services, tax preparation, or auditing, including itemised charges and payment terms.

- Wholesale Businesses: Send invoices to retailers for bulk orders, allowing for clear documentation and efficient payment.

- Custom Order Businesses (Designers, Manufacturers): For bespoke products or services where the final cost is determined after consultation, invoices provide a professional way to bill clients.

- Event Organisers: Bill sponsors, vendors, and clients for participation fees, booth rentals, or professional services.

- Freelancers (Writers, Designers, Developers): Invoice clients for completed projects, articles, graphic designs, or website development, detailing hours and deliverables.

- Landlords/Property Managers: Send invoices for rent, security deposits, or specific maintenance charges to tenants.

- Healthcare Providers (Clinics, Therapists): Issue invoices for medical consultations, therapy sessions, or specific procedures not covered by insurance, or for co-pays and deductibles.

Ready to Simplify Your Billing?

Buzz Business Cloud empowers you to take control of your billing and payment collection process. By leveraging Buzz Invoices, you can enhance professionalism, improve cash flow, and free up valuable time to focus on growing your business.

Sign up for a Buzz Business Cloud account today and experience the ease of digital invoicing! You’ll also discover our full suite of payment solutions, including Payment Links, Subscriptions, Appointments, and Donations for NGOs.